24 september 2025

Relative stability characterises the third quarter of 2025

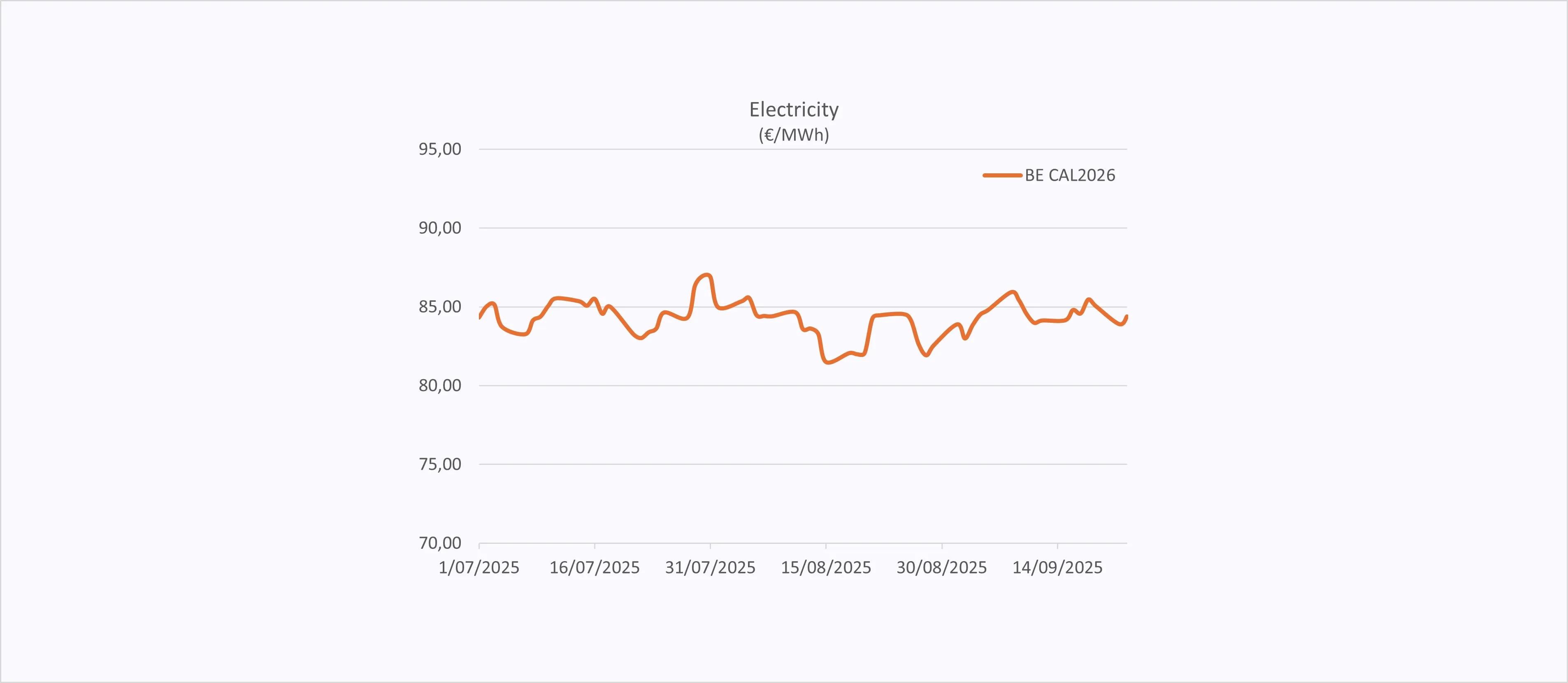

Electricity – July drop after supply tensions, but price signals distorted

The CAL26 BE Power product, which reached as high as 90,44 EUR/MWh at the end of May, corrected downwards by nearly 10% after diplomatic breakthroughs between Iran and Israel reduced regional risk premiums. The peace treaty is still holding and the tension in the Strait of Hormuz deescalated. Apart from this deal, the US also insisted on a solution for the Russian war in Ukraine. Although the talks didn't lead up to a major breakthrough, the markets eased after Trump’s initiatives. During Q3 the price for CAL26 BE was hovering between 81 and 86 €/MWh.

Despite the correction after the high tensions end of May, market dynamics for power remain complex, especially on the spot market. Overcapacity during sunny days combined with inflexible nuclear and flexible use of an increased CHP output has led to negative spot pricing events. Although the number of negative hours is boosting, the price of the negative hours is tempered by the activation of curtailment of renewable sources. Belgium’s and the EU's growing solar and wind capacity is reshaping the curve, with price volatility now more weather-dependent than ever.

As heat waves were present, in almost all countries within the EU, also the rivers and lakes heated up. As a consequence, some nuclear reactors had to diminish their output, since they were running out of cold water for cooling purposes. Even some jellyfish disturbed the nuclear capacity in France by blocking filtration systems. Apart from this, also the boosted cooling demand during the evenings were having an impact on spot prices. Hence, the result was an average spot price of 83,07 €/MWh in July. Whereas the average price in May and June had been around 63 €/MWh. In August, the spot price fell to an average of 69 EUR/MWh, driven by lower demand due to more normal weather conditions and higher wind generation.

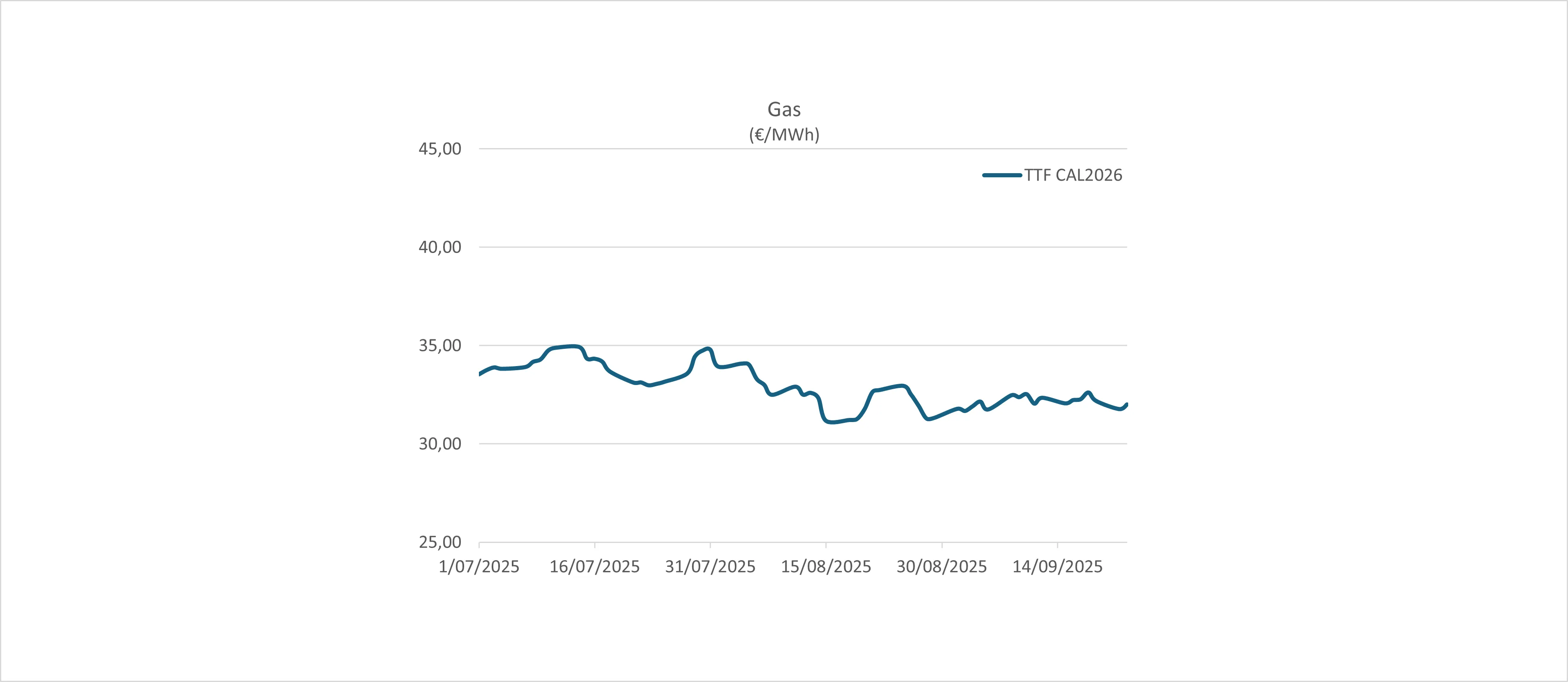

Gas – Geopolitical tension fades, but fundamentals stay tight

Gas prices began Q3 with sharp volatility. In mid-June, amid escalating Middle East tensions, European TTF spot prices surged to reach around 41 €/MWh — one of the highest levels since late February. By early September, both the Dutch TTF spot and CAL26 settled near 32 €/MWh, marking a pullback after the ceasefire between Israel and Iran was signed.

Although structural tightness persisted through Q3, the CAL26 forward price kept hovering around its lowest price in 1 year. Europe saw power generation by gas spiking in demand, when renewable output and full nuclear capacity were constrained by the heat. European gas storage rallied with a strong injection rate reaching around 80% fill ratio which is still short of the EU’s 90% target, but is slowly moving towards that objective. Global LNG flows stayed robust, with even record-breaking export levels from the US in August.

Nevertheless, the market balance remains delicate, particularly vulnerable to abrupt shifts in weather or industrial demand, and prone to geopolitical tensions.

A notable development is the first sanctioned cargo delivery to China by the Russia’s Arctic LNG 2 project in late August, with several other LNG ships seemingly under way to Southeast Asia. Furthermore, progress was made on the Power of Siberia 2 project between China and Russia. Despite the public intentions, several hurdles need to be taken before the project is confirmed. The timeline for the possible commissioning of the pipeline is expected to be after 2030. This growing Asian-Russian link, despite US’ sanctions, may exert downward pressure on European gas prices, if it materializes.

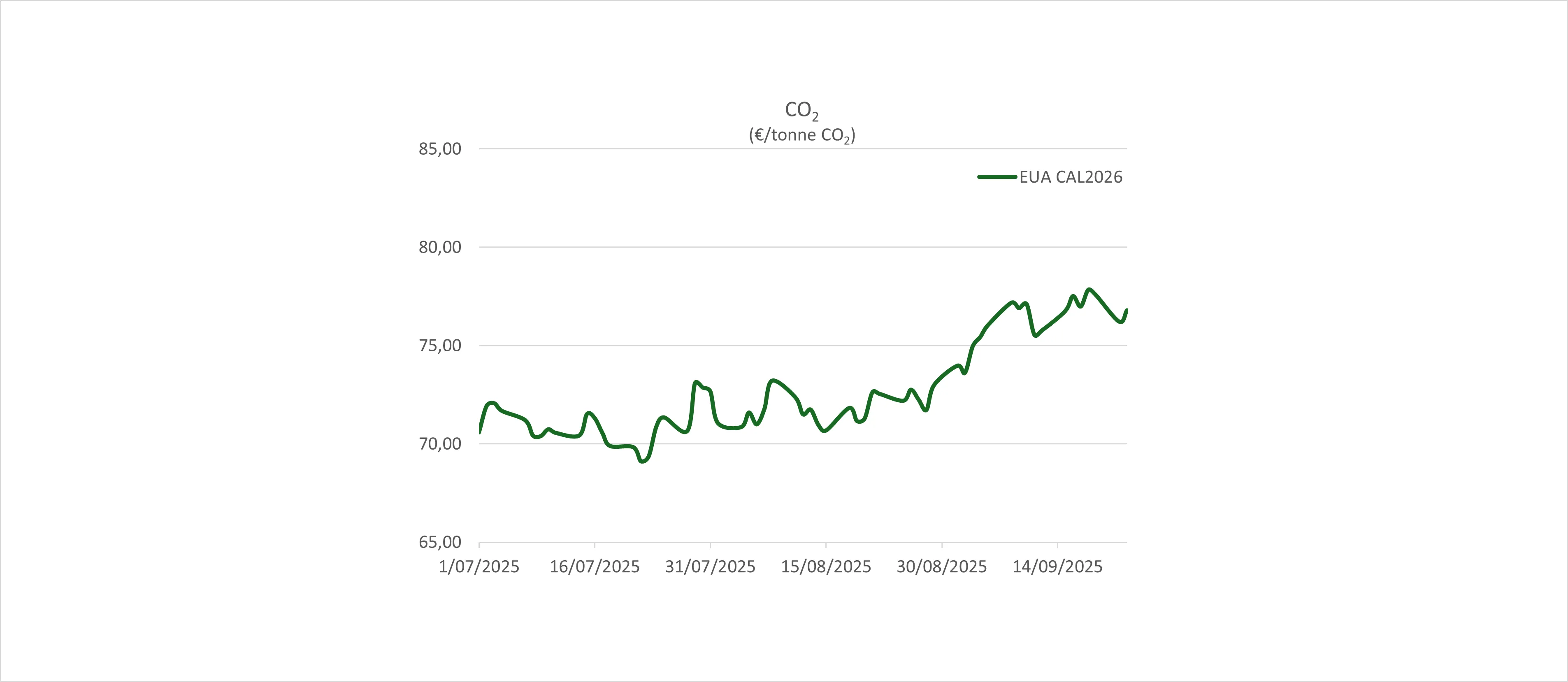

CO₂ – Calm now, but 2026 tightening looms large

Carbon markets stayed relatively steady with an upward trend near the end of Q3 with compliance deadline of 30 September closing in. The average price for EU Allowances (EUA) in July and August hovered around 70,8 €/tonne, while the average price has crept up in September to 75,4 €/tonne.

Looking ahead, structural factors point toward higher EUA prices. Reform measures — including a tighter 2026 cap, reduced free allocations, and the introduction of the Carbon Border Adjustment Mechanism (CBAM) — are expected to shrink supply and the willingness to sell, and push prices upward