18 december 2025

Gas markets at the brink of a new era

Gas markets at the brink of a new era

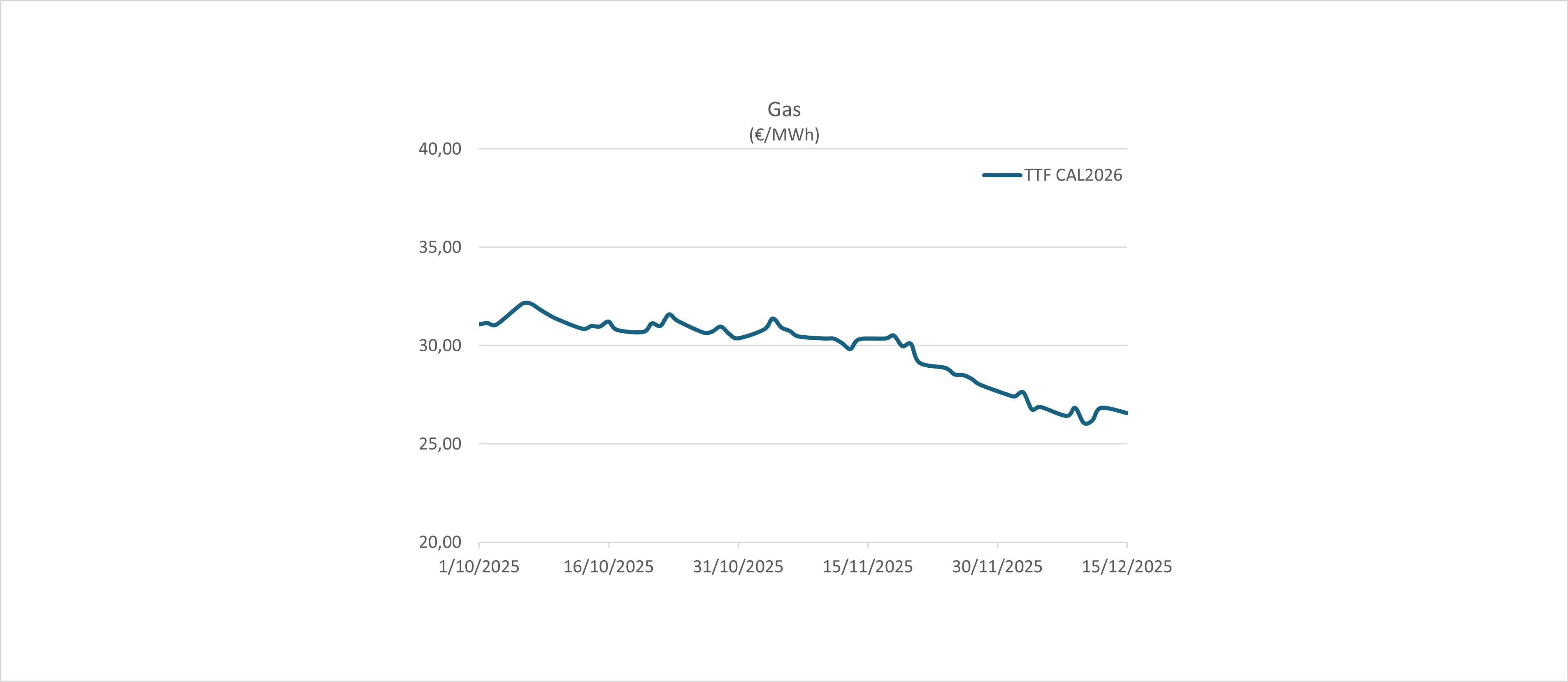

Gas spot and futures prices continue their downward trend, driven by mild weather and stable, ample LNG supply. TTF gas spot prices are now at their lowest levels since April 2024, and TTF CAL26 is at the lowest level since March 2022. Further declines are being limited by the rise in US gas prices – the benchmark for many LNG export contracts – as local winter temperatures push up domestic demand. This is not insignificant, given that around 60% of Europe’s LNG imports come from the US. Lastly, a peace agreement between Russia and Ukraine could open the door to a further decline in gas prices driven by positive market sentiment.

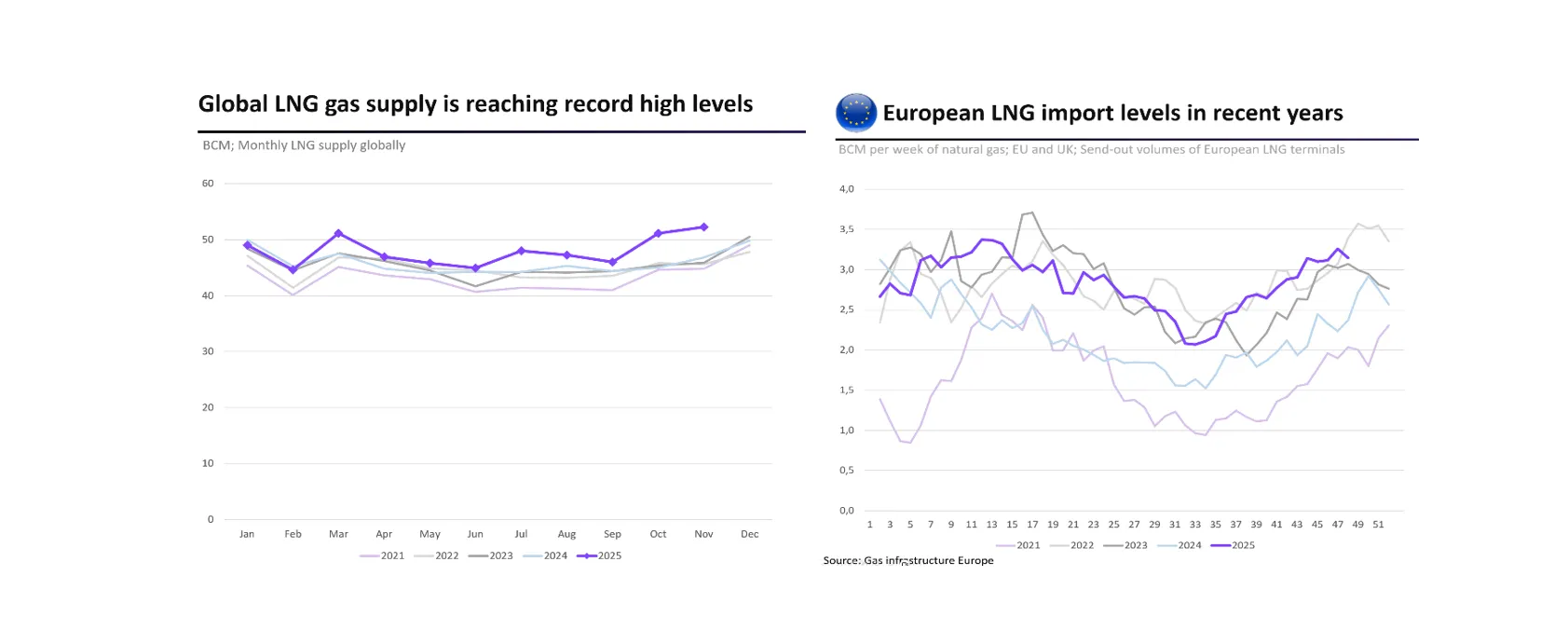

LNG at an all-time high

The LNG market is at a turning point. After years of tightness, the balance is shifting toward a supply-driven dynamic. Large-scale production expansions in the United States and Qatar are set to drive significant growth in global LNG export capacity through 2030. This comes at a crucial moment for Europe, which has become heavily dependent on LNG following the ban on Russian pipeline gas. European LNG imports have reached an all-time high this year, supported by the continuous build-out of regasification capacity. This surge in import capability is precisely what enables Europe to benefit from the new market reality emerging as from this winter: a more comfortable LNG environment underpinned by strong global supply growth.

On the other hand, competition from Asia in the LNG market has been limited during October and November. As for Asia — home to the world’s two largest LNG importers, China and Japan — a mild winter is also forecast. Moreover, aside from the lower heating demand, both countries have already secured the heating fuel they need for the coming months through long-term contracts, and storage levels are sufficiently high to cover any unexpected cold spell. This removes the worst-case scenario: a sudden cold snap in Europe or Asia triggering a bidding war for LNG and straining a finite supply pool. This dynamic, in combination with the ample LNG supply, helps explain the easing in the market observed in Q4. Nevertheless, in a market no stranger to volatility, an unexpected cold spell, LNG terminal outage, or a major geopolitical event could still send prices sharply higher.

Lower EU gas storage, no reason to worry

In Europe, the gas storages are currently at 71%, which is roughly 8% below those of 2024. The Dutch and German storages in particular did not reach the 90% fill target. This deficiency can be explained by the so called ‘backwardation effect’, i.e. gas is more expensive at the time of buying, than it will be at the time of selling, which does not create any economic incentive to fill the storages beforehand. Unlike last year, however, these lower storage levels have not triggered any market concerns, thanks to mild winter temperatures and strong LNG inflows that can comfortably absorb any additional demand.

Geopolitics: Cautionary optimism regarding the peace agreement between Ukraine and Russia.

Since the start of the war in Ukraine, a wide range of Russian gas and oil facilities have been placed under sanctions, and just last week two major Russian oil companies were added to the list. In terms of LNG capacity is Russia remains one of the world’s largest natural gas producers, with very large reserves. Should a peace agreement eventually be reached, this gas and oil capacity could return to the international market, which would indirectly exert downward pressure on European gas prices. As the peace negotiations progressed, the optimism in the global energy market of additional supply was strengthened.

At the same time, Russia continues to target the Ukrainian energy infrastructure. Nearly 60% of Ukraine’s domestic gas production has already been taken offline as a result of these attacks. Ukraine is compensating for this loss partly by maximizing output at remaining domestic sites, and partly through increased gas deliveries from neighbouring countries such as Hungary, Poland and Slovakia.

Mind that the effects of the peace agreement between Russia and Ukraine would be rather an indirect effect on the European gas supply as the EU officially approved last week a ban on Russian LNG starting in 2027. Combined with the existing ban on Russian pipeline gas introduced in 2025, Europe is further cementing its ambition to become fully independent from importing Russian gas.

Lower EPEX-prices in Q4 y-o-y

In Q4 EPEX prices have largely remained below €100/MWh, with only a few brief spikes. Also here are the same factors at play: mild temperatures – lowering heating demand – combined with good wind output – strengthening power supply. The brief power price spikes that occurred, can be attributed to several moments when gas-fired power plants delivered higher output during periods of lower wind output. Flexible gas-fired power plants are playing a key role in accommodating wind swings to ensure system integrity and electricity supply security. Overall, gas units were used less, as high wind generation covered more demand. In October and November, wind output was 54% higher than during the same period last year. This surge in renewable production, in combination with mild temperatures, kept EPEX prices relatively low.

In line with the decreasing gas prices, the forward CAL-26 power prices fell sharply as from December, reaching €76/MWh in the second week of December. As the year-end approaches, Belgian CAL-26 and CAL-27 forward power prices are converging and were trading at broadly similar levels as the market support rolls into the next Y+1 product.

Carbon prices continue to rise

The Dec 25 EUA contract reached 84,25 EUR/tonne last week, its highest since 31 January 2025. EUA-prices may rise before the end of the year as several factors drive bullishness in the carbon price. Firstly, the economic picture is improving amid a decision by the US central bank to cut interest rates. Second, as the Dec 25 EUA is closed, investment funds sell their positions and roll into the EUA Dec 2026 product. This year, that may be even more pronounced given tighter auctions in 2026, leading to a potential shortage of EUAs. This indicates the third, and most important reason, potential tightness in the CO2 market as from 2026. EUA market analysts, including ICIS and Vertis, indicated in their latest outlooks that the EUA Dec 2026 contract is likely to break above €100/tonne. The concerns on market tightness are further reinforced by speculative long positions taken by investment funds, which are increasingly active in the carbon market.

The upward trend of the EUA-prices partially limits the further decline of the forward Y+1 power prices following the gas prices. In Q4, between 1 October and 11 December, TTF Cal-26 gas prices fell by 17%, while power prices declined only by 8% over the same period. The difference in magnitude is largely explained by the ascent of EU carbon prices in recent weeks. Since 1 October, the CO₂ price has in fact increased by 10%, limiting the downward movement in electricity prices.