26 juni 2025

Geopolitical tensions continue to dictate the energy market

After the turbulent start of the year, energy markets have cooled off and prices returned to lower levels. From consistent elevated spot power prices of +100 EUR/MWh and +50 EUR/MWh spot natural gas prices during Q1, an average of 72.75 EUR/MWh for power and 35 EUR/MWh for natural gas are observed in Q2. Many factors have contributed to this decrease, but the general economic outlook following the tariff trade war that was started by president Trump, has been critical.

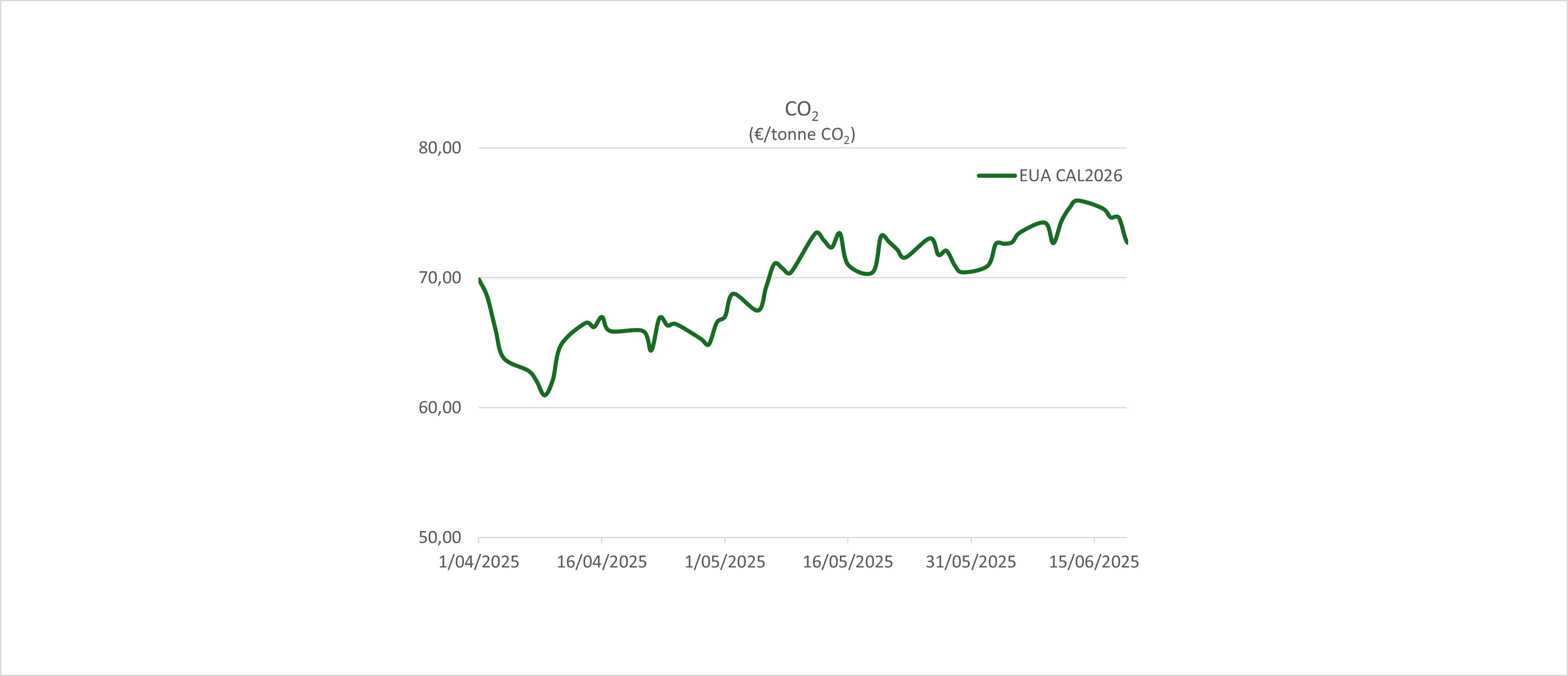

On 2 April, the White House issued an executive order under the so called “Liberation Day” statement where a baseline import tariff of 10% would be exercised on virtually all countries as of 5 April. On top of that, all countries with large trade deficits with the USA would receive additional reciprocal tariffs starting from 9 April. These tariffs were out of proportion in size causing a global economic shockwave. Following this step in the trade war, countries started negotiating or publishing their own retaliation tariffs. China, as an important trading partner, did strike back particularly hard. Both the economic impact as well as the possibility of LNG flow changes have pushed prices downwards.

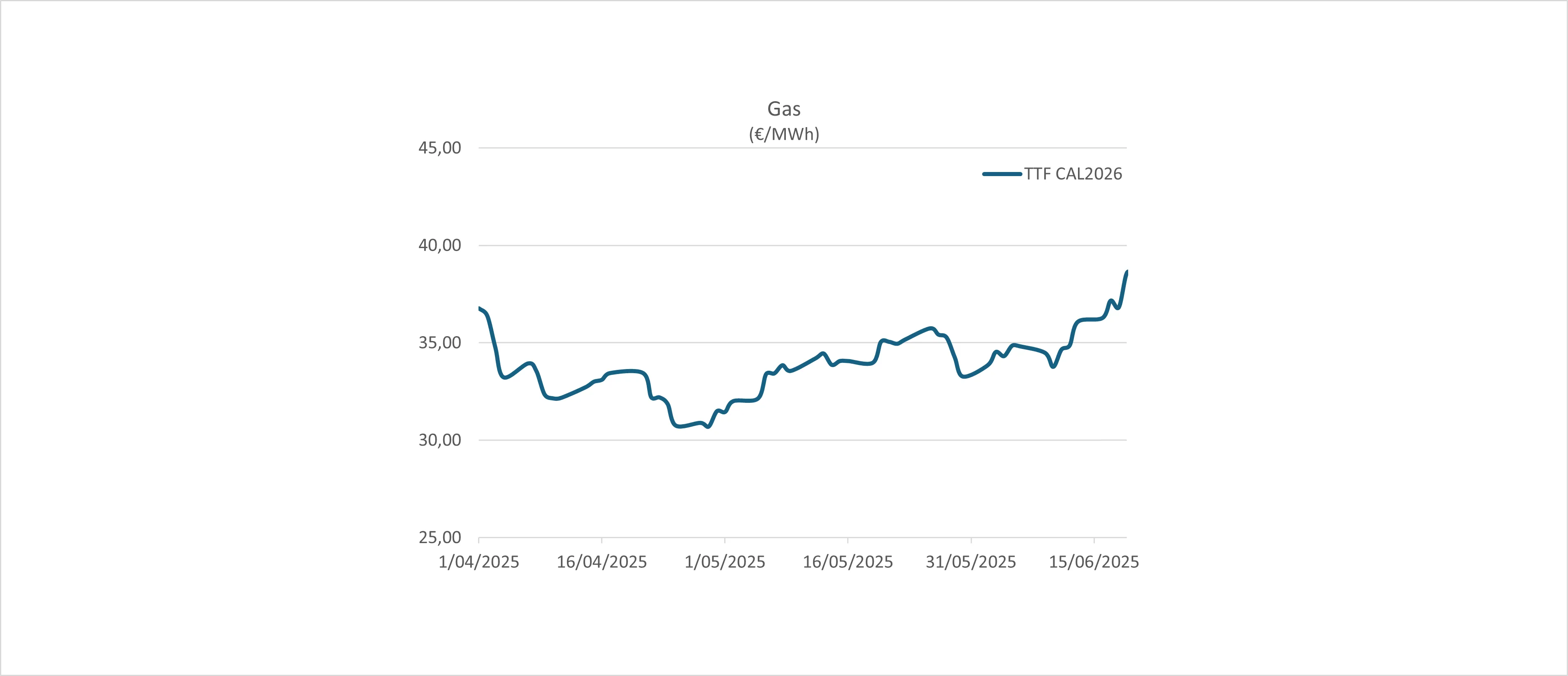

The CAL26 TTF product, which topped out at 44.71 EUR/MWh in Q1, now dropped as low as 30.70 EUR/MWh on 29 April, a decrease of 31%.

CAL26 BE Power reached price levels as high as 98 EUR/MWh in Q1 and decreased with 20% to 78.38 EUR/MWh on 9 April.

Those moments were key, but were also the moments when panic levels were really high. In the following weeks, more negotiations followed which resulted in tariff breaks and consensus deals calming and restoring the markets.

Another reason why the prices have come down from the elevated beginning of 2025, is the recovery of the output from renewables. The winter period has obviously a seasonal reason for lower power generation from solar, but Q2 has shown 85 TWh of output in Europe, which is 30% higher YoY. When the wind output is added into the mix, the story becomes even clearer. While Q1 has been dramatic with -15% compared to 2024, the wind output showed a strong recovery in Q2, but unfortunately not yet to the norm. The weather stays an important price driver. Unfortunately not only the volatility in the markets but also the weather phenomena can suddenly change from extremely wet periods into history record breaking dry spells.

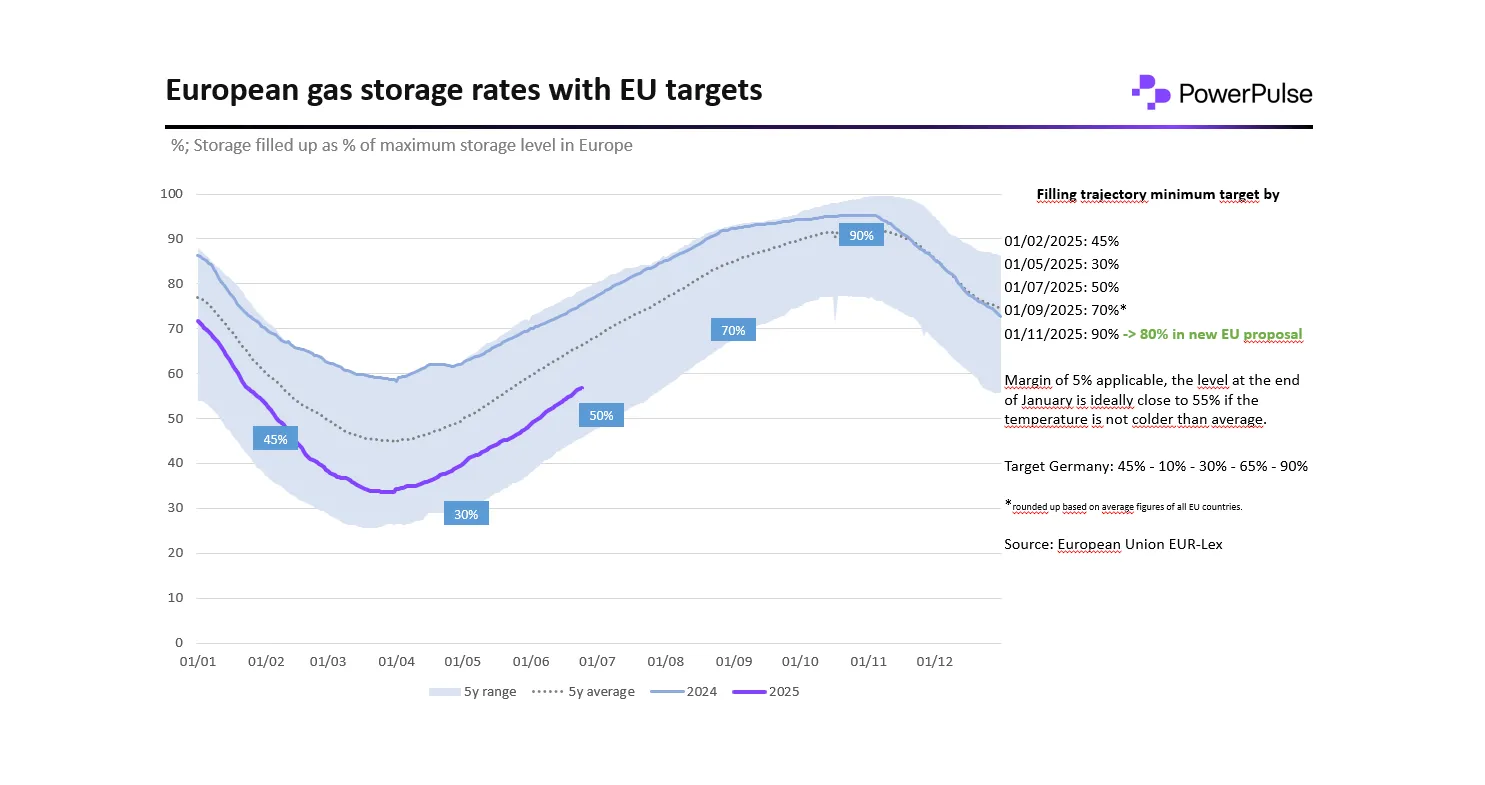

In May, the energy markets received more downward pressure. This time from the EU Parliament who proposed to lower the mandatory gas storage filling target by 1 November from 90% to 83%. Their aim was to balance energy security with market conditions. Several industries had reached out for high energy prices in Europe in general and for the anomaly where summer forward natural gas prices noted significantly higher than the prices during winter. The latter is contradictory to the market fundamentals where prices in summer should be lower due to lower demand.

The low European gas storage rates in Q1-Q2 were the main reason for this agitation. With an overall filling level of only 33% in April, 60 billion cubic meters will have to flow back into the storages to reach the target. Such significant volume will have to be bought from the market during filling season in the next 6 months and is reflected in the current market prices. In the meantime, filling is happening at an increased rate. The targets will be reached before the deadline if Europe can keep up with the current pace and if all fundamentals remain as they are now without any sudden shifts which will impact the markets.

The EU didn’t wait long to announce to further restrict natural gas flows from Russia, from a ban on Nord Stream pipeline transactions to a full phase out from Russian LNG by the end of 2027. This news caused prices on the energy markets to surge again.

Another key fundamental in the European energy markets has been the availability of the French Nuclear park. With record numbers in Q1 the predicted availability has been dropping in the past weeks. Recently, strss corrosion cracking problems have been discovered again (hopefully not disaster year 2022 all over again). On top of that, the potential heat waves could impact the availability even further during the summer period.

Last but not least, the geopolitical escalation risks have been the centre of discussions for over a year. Most conflicts have not yet escalated beyond the initial parties, but the conflict in the Middle East is entering a new phase with the active involvement of Iran after a targeted precision strike on their nuclear targets from Israel.

A potential retaliation from Iran could have been the blocking of the Strait of Hormuz. This would be a disaster for the energy markets as 20% of the world’s LNG exports and crude oil production flows through this point. Iran was rather hesitant to act knowing that Saudi Arabia and the UAE have back-up pipelines to by-pass the Strait of Hormuz, while Iran desperately needs the strait for their own exports to China. The situation in the Middle East appears to be deescalated with the current peace treaty in place. We keep advising to follow the hedging strategy outlined by your PowerPulse consultant to mitigate any further risks.