27 maart 2025

A rollercoaster to start off 2025

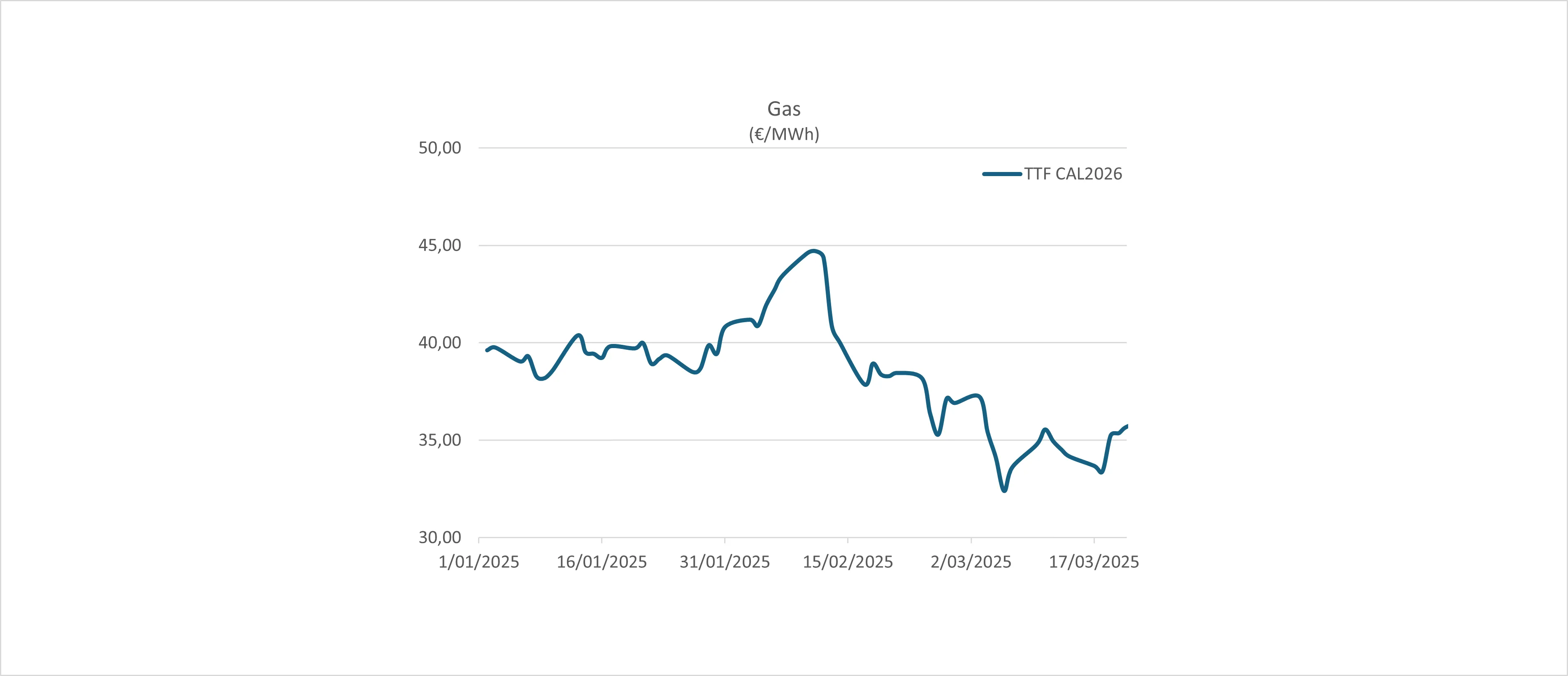

The rollercoaster ride started pretty flat during the first weeks of the year after a sharp increase in prices of both electricity and gas at the end of December. Besides a first warning shot being fired when the spot price for gas peaked for a first time at 50 €/MWh on January 2nd, business returned to the usual (but rather high) prices during the first weeks of January around a rather stable price level of 45-48 €/MWh. At that time Europe was facing a cold and wet January. Nothing unusual one would say, though this was for the first time in 6 decades without Russian gas flowing through Ukraine as the transit agreement between the two nations came to an end on the 31st of December 2024. As an unwanted extra there was less wind than during a usual January. As a result of this ‘perfect storm’ the European gas reserves were shrinking at an alarming rate. Starting 2025 at 72%, one month later the storage levels would stand 19% lower at 53%, a level not been seen in 2024.

It was around this time that the rollercoaster ride would really begin. Winter was more fierce than other years and temperature and wind provisions continued to be revised downwards. Moreover Trump was threatening to start a tariff war with a Europe desperately needing US LNG volumes. Panic started to appear on the energy markets, not only on spot but also on the forward markets. In only two weeks’ time the TTF spot price rose from 47,64 €/MWh to 58,31 €/MWh on February 10th, an increase of more than 20% and the highest level in over 2 years. At the same time, Belpex prices were averaging 140 €/MWh. Was Europe on its way again to a new energy crisis?

The answer to this question would follow soon. This peak moment would turn out to be the top of the rollercoaster ride and markets were about to start their ride down.

Temperature previsions appeared to indicate warmer weather with the first signs that winter could potentially come to an end. The second half of February turned out to be sunny and warm, meaning a slower depletion of the gas reserves. Due to the high spot prices for gas, LNG volumes continued to be attracted to the European shores. February saw a total of 15,9 bcm of LNG imports, close to January’s 16 bcm – a 2 year high and the strongest start of a first quarter ever. Together with a steady supply from Norway, these volumes were further attributing to a slower depletion of the gas reserves. In the meantime Trump surprised the world after his phone call with Putin telling the war in Ukraine could soon be over. Markets saw this as a potential sign that gas flows from Russia could soon return to find their way into Europe. Moreover the European Commission agreed to loosen the filling requirements of the European gas storages, allowing member states to no longer strictly reaching 90% filled storages by 1st of November 2025, but by 1st of December under certain circumstances. All of the above caused the energy markets to relax.

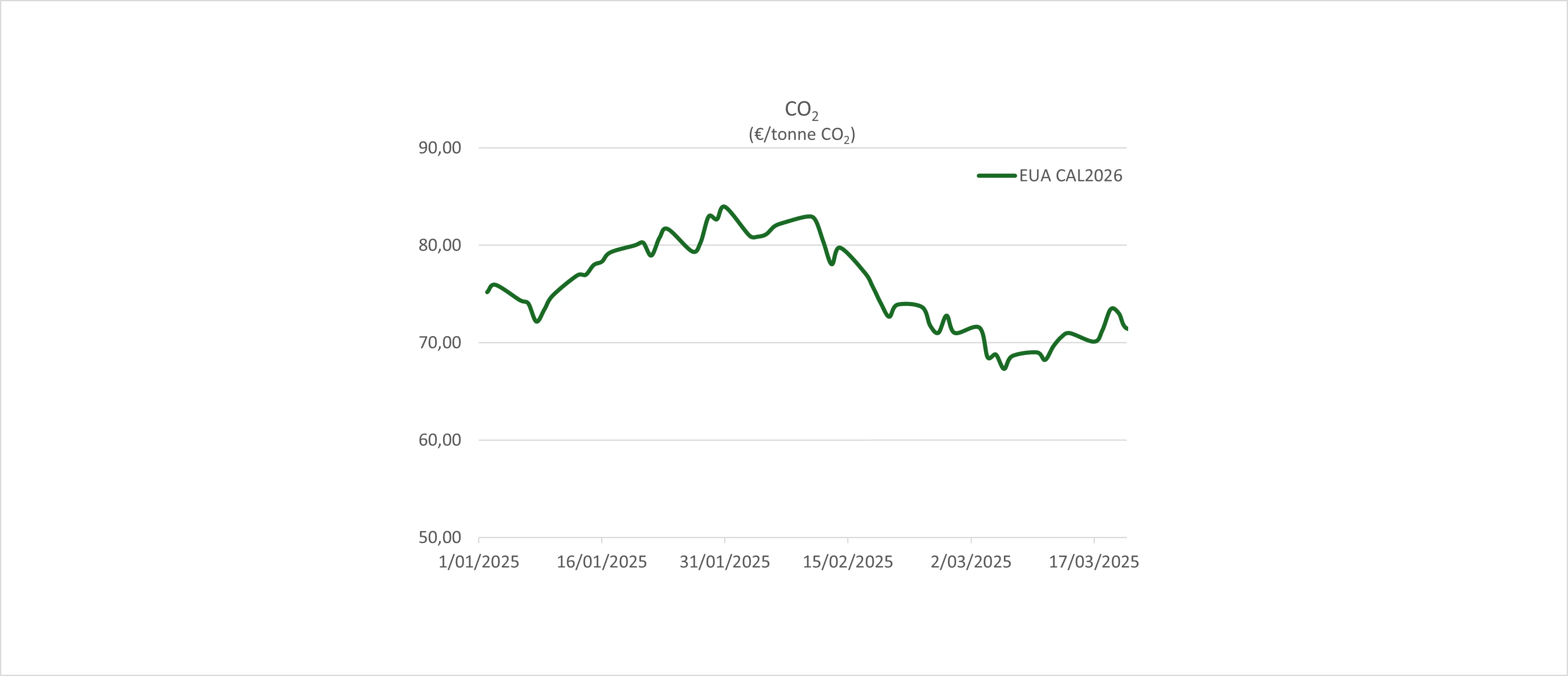

TTF spot prices fell by more than 35% (or 20 €/MWh) from the peak of 58,31 €/MWh to 37,63 €/MWh in just about three weeks’ time. Forward prices fell significantly as well hitting near 6 months low. Carbon prices fell to levels well below 70 €/tonne due to bearish economic outlooks caused by a tariff war started by Trump. Forward electricity prices followed this trend dropping heavily as well.

So far 2025 has proved to be a very volatile year on the energy markets and it sure is not over yet. Nearing the end of the winter season storage levels are now below 35% and still continue to decrease, meaning a serious effort will be needed in the upcoming months to get them back to the required 90% target level. LNG volumes will be needed and the competition for these volumes with Asia will not allow gas prices to crash sharply in the near future. Also geopolitically things seem rather tense. The ongoing Russia-Ukraine peace negotiations are a rollercoaster on their own, as are the thoughts and decisions of Trump. Where all of this might lead us? Good question, but difficult to answer... Just keep in mind that a structural hedging strategy can protect you against the rollercoaster ride we find ourselves on. For more information, feel free to contact your PowerPulse consultant.