27 juni 2024

A volatile energy market in Q2 2024

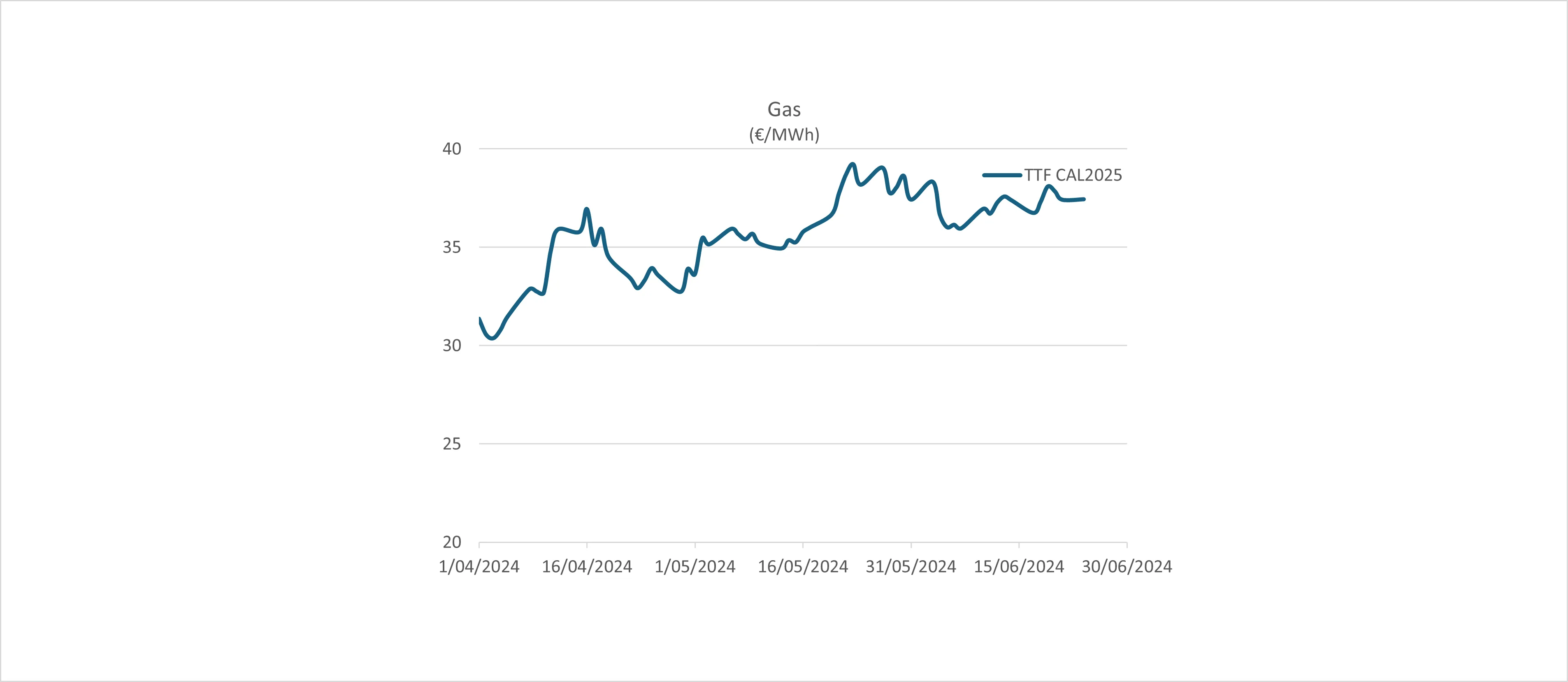

After a dwindling trend in the first quarter, the various energy markets resumed their upward trajectory. A multitude of price driving factors mainly affected the gas market, with the emission rights and electricity markets also following suit.

The ongoing conflict between Russia and Ukraine, where also European gas reserves in Ukrainian caverns were targeted, seems to be less of a concern for the market. However, there remains uncertainty about whether or not the transportation contract of Russian gas through Ukraine will be renewed, which expires at the end of this year. This has an impact on gas market volatility. Further escalations in the Middle East are also hanging over the market.

Europe, meanwhile, is largely dependent on US LNG supplies. There, the Freeport terminal is still struggling to revive production after frost damage in January and other work on the facility. The lack of communication from the operator is making the market somewhat nervous.

Norwegian gas exports have also experienced the various problems in addition to the planned maintenance work that has made itself felt on the gas market.

Summer is still delayed. With reduced wind and solar production, gas and coal-fired power plants have to run harder.

Despite lower (industrial) gas demand and favourable gas stock levels, the above-mentioned 'bullish' cocktail has caused firm price increases. Still, these price drivers are considered relatively short-lived with long-term prices for 2027 and 2028 remaining virtually unchanged.

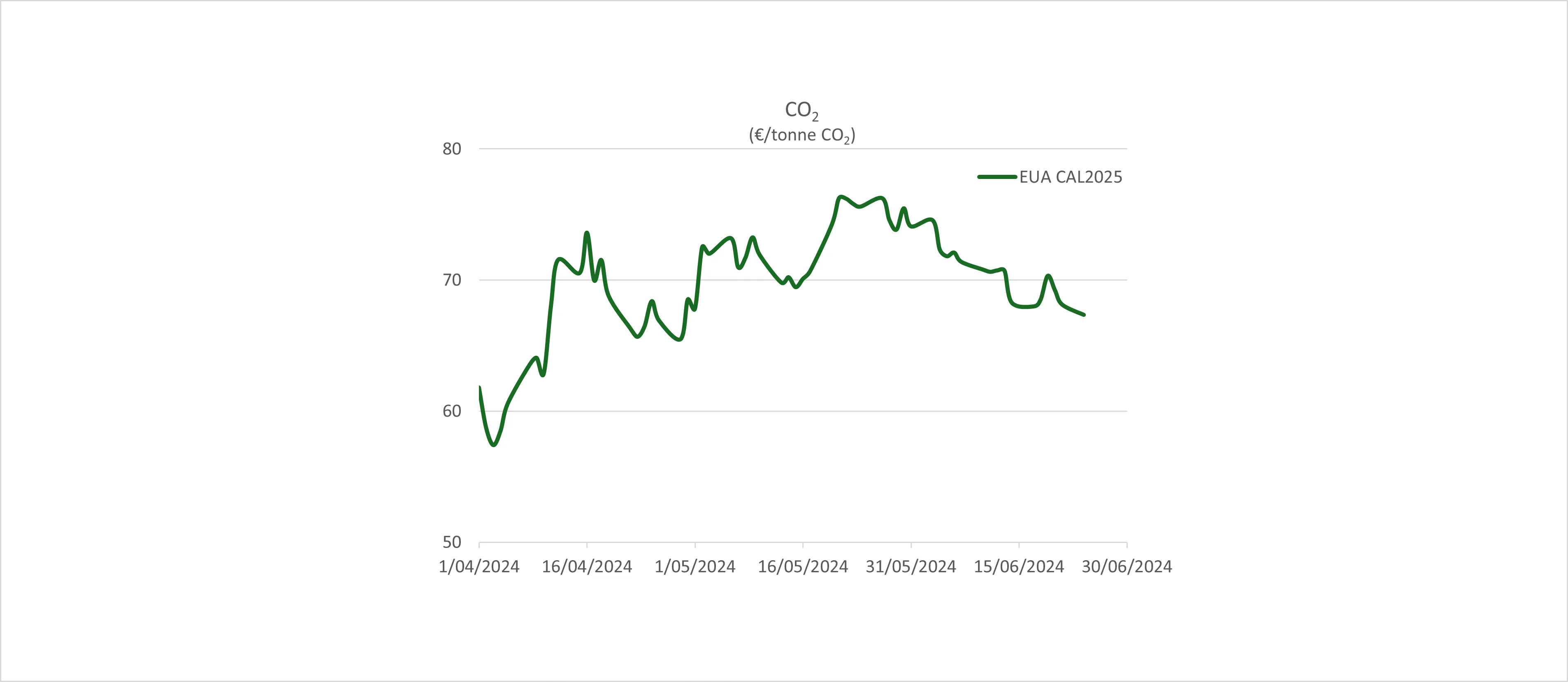

As the electricity market closely follows the gas market and the gas market is in backwardation (long term prices quote lower than short term prices), the electricity prices rose for contracts up to the end of 2025. On the periods thereafter, we see the higher CO2 allowance price impacting the electricity price rising considerably faster than the gas price. European hydro and nuclear power plants are running a lot better than the average over the past few years. This significantly increases the number of negative hourly prices on sunny days and keeps the prices of guarantees of origin low.

The CO2 allowance price had slipped around €50/t last quarter as industrial demand remained low and strong wind combined with high temperatures reduced the need for allowances. However, at the same time as the gas price, the CO2 allowance price also rose sharply. The explanation for this is twofold. On the one hand, lower-than-expected temperatures and moderate wind production meant that gas and coal-fired power plants had to step in whereby CO2 allowances were needed to cover CO₂ emissions. On the other hand, traders and speculators often go 'short' on falling prices. When prices rise, they close the short position by buying carbon allowances again. If enough parties execute this, you get a 'short squeeze' which accelerates the price rise. Currently, the market around CO2 allowances has calmed down again.

If you want to know more about the evolution of the market and the expectations for the coming months, do not hesitate to contact a PowerPulse consultant.