19 december 2024

Is history repeating itself?

A definition for the economy is the study of how people allocate scarce resources for production, distribution, and consumption, both individually and collectively.

The Russian-Ukrainian war has been raging for over 1,000 days. This also marks the European pledge to move away from Russian pipeline gas, towards sourcing LNG on the international market (Liquified Natural Gas which is delivered via vessel). The end of an era with stable supply of natural gas, and the beginning of high volatility in both supply as in prices. A limited amount of LNG (and LNG vessels) is available in the market: it is a scarce resource. The LNG market was generally predominated by the Asian market, with Asia (JKM market) paying a premium to the EU (TTF) prices to attract LNG vessels.

The European Commission set out a trajectory for gas storage filling, with a target of minimum 90% filled by November 1st. In 2022, this target pushed gas storage owners to source gas at any cost to achieve this target, and they received support from the European Commission in sourcing these volumes. Leading to the price peak of August 2022.

Since then, the energy crisis gave towards the outside world the impression of being a storm in a tea cup: There was still sufficient gas available after the winter of 2022/23 and 2023/24, these winter are marked with very mild temperatures and healthy renewable output.

This year, we left the winter with historic high gas storage levels and energy prices had been decreasing until then. We decreased our demand for LNG since we were in a comfortable position and storage owners were reluctant to sourcing gas at any cost, with the 2022 trauma in mind. Everything will be fine.

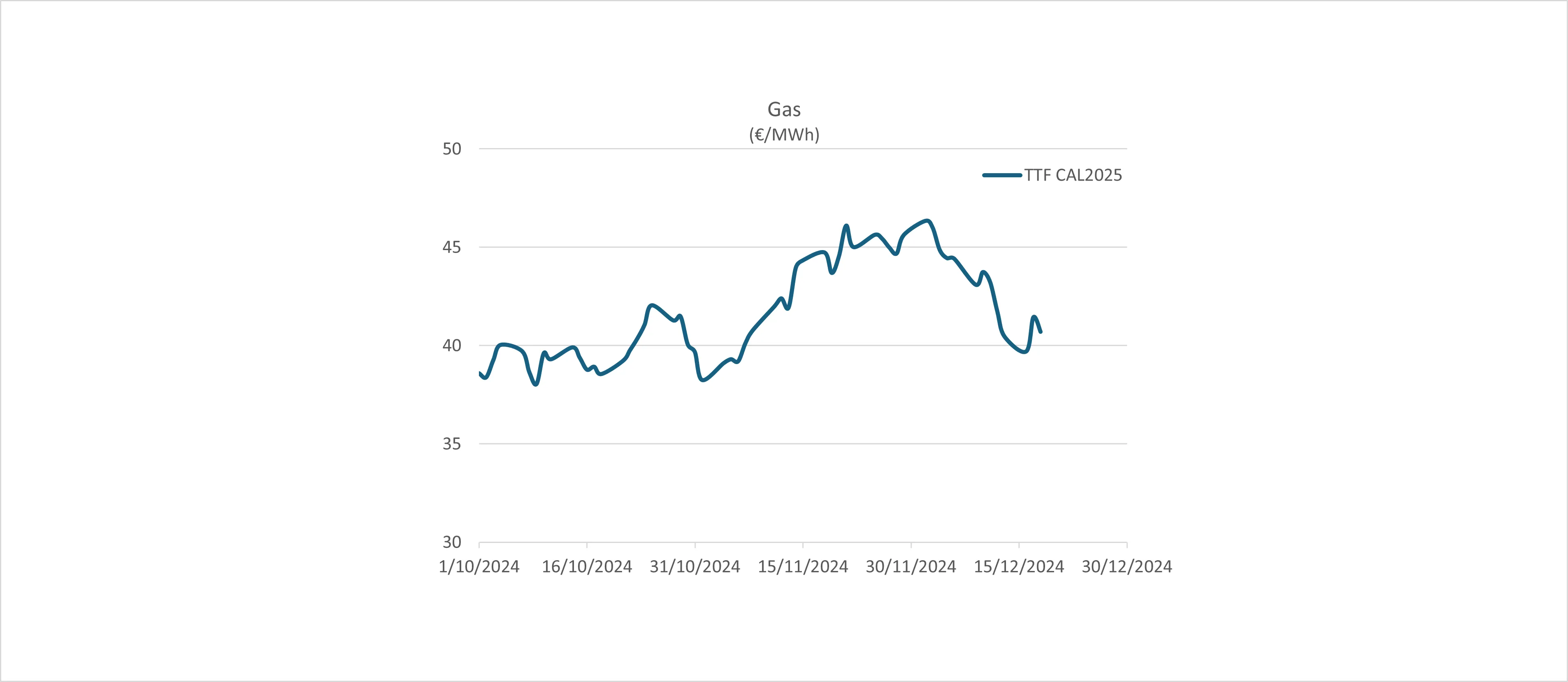

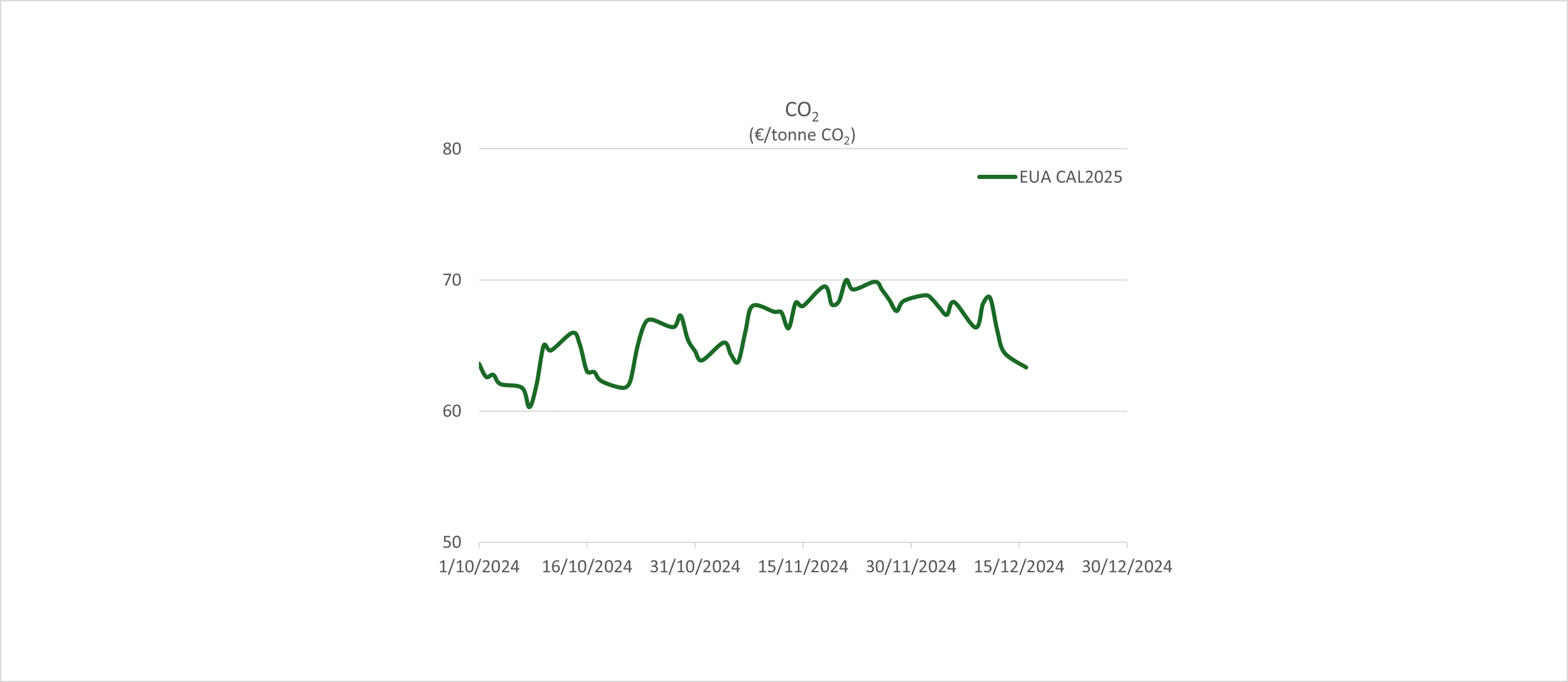

However, gas prices have been slowly creeping upwards since February 2024, driven by macroeconomics in EU, Asia, and US, cooling demand in Asia (with Japan experiencing a heatwave for several months), geopolitical tensions (mainly Russia-Ukraine and Israel-Iran tensions), unavailabilities, …

The injection rate to fill the gas storages was lacking behind in comparison to the previous years, and the import of LNG was dropping as well; The Asian market was willing to pay more for LNG than the European market. Since the target was well in sight, there was little real pressure to attract more volumes, and some purchases were floating on a false sense of security that we would experience a mild winter and/or renewables would save the day.

We have experienced a first period with temperatures being below seasonal average, while renewable output is lagging behind (“Dunkelflaute”, a period marked with low solar and wind output), and the nervosity is already back in the market: prices increasing steeply in a hope to deter high gas consumption and to attract additional LNG volumes.

Like it was often stated during the US – elections night: “to early to call”, but haven’t we learned from the past that we are floating on a false sense of security, and putting our eggs once again in a few (and rather volatile) baskets? Relying on renewable energy, while it is not 100% certain that it will meet the same performance as last year; Relying on few partners to source natural gas; Relying on no supply interruptions; Reyling on climate change pushing the average temperature during winter upwards; …

The United States are our primary partner for the delivery of natural gas. Hoping that the next president of the US will be EU-friendly instead of focusing on internal problems. With the election of Trump, this hope is scattered. We know that Trump is fossil-friendly (Drill, baby, Drill) and would ease the permitting process of new projects for oil and gas, but we don’t know what the focus will be. There are already two schools of thought: one school prescribes that the US market will be flooded with very cheap oil and gas, the other school thinks these new projects will be export - focused to capture as much value as possible. We know that we are looking at the US as our primary partner for LNG, but to what extend can we push this trust?

The EUR/USD currency rate is favoring the US Dollar over the Euro, making importing from the US more expensive; and the expectations are the US Dollar will devour the Euro even more under the Trump Administration. Since the international LNG market has the US Dollar as trading currency, importing natural gas becomes even more expensive.

As already stated, it is too early to call what the energy markets will bring in the near future, and only time will tell, but we should look more back in time to prevent the same mistakes from happening again.

If you want to know more about the evolution of the market and the expectations for the coming months, do not hesitate to contact a PowerPulse consultant.