26 september 2024

An unexpected bearish energy market in Q3 2024

One of the oldest clichés in energy procurement is: “You should always buy power and natural gas in the summer because that’s the period when they are the cheapest.” It’s fair to say that there is some truth in that statement when it comes to certain hourly spot price levels for power or specific forward products of natural gas. In some years you could indeed notice a serious dip in the market allowing you to improve your overall budget position. However, it’s not always the case. Look back at the energy crisis in 2022 when the European front year gas price reached an all-time high of 312 EUR/MWh in August. The maximum price levels in the power market around that time were even more staggering with levels above 700 EUR/MWh and even more than 1.100 EUR/MWh in certain countries. Prior to the European energy crisis, we had Belgian power prices peaking in the summer of 2014 and 2018 due to the fissures in the Belgian nuclear reactors and low French nuclear availabilities, effectively debunking the cliché.

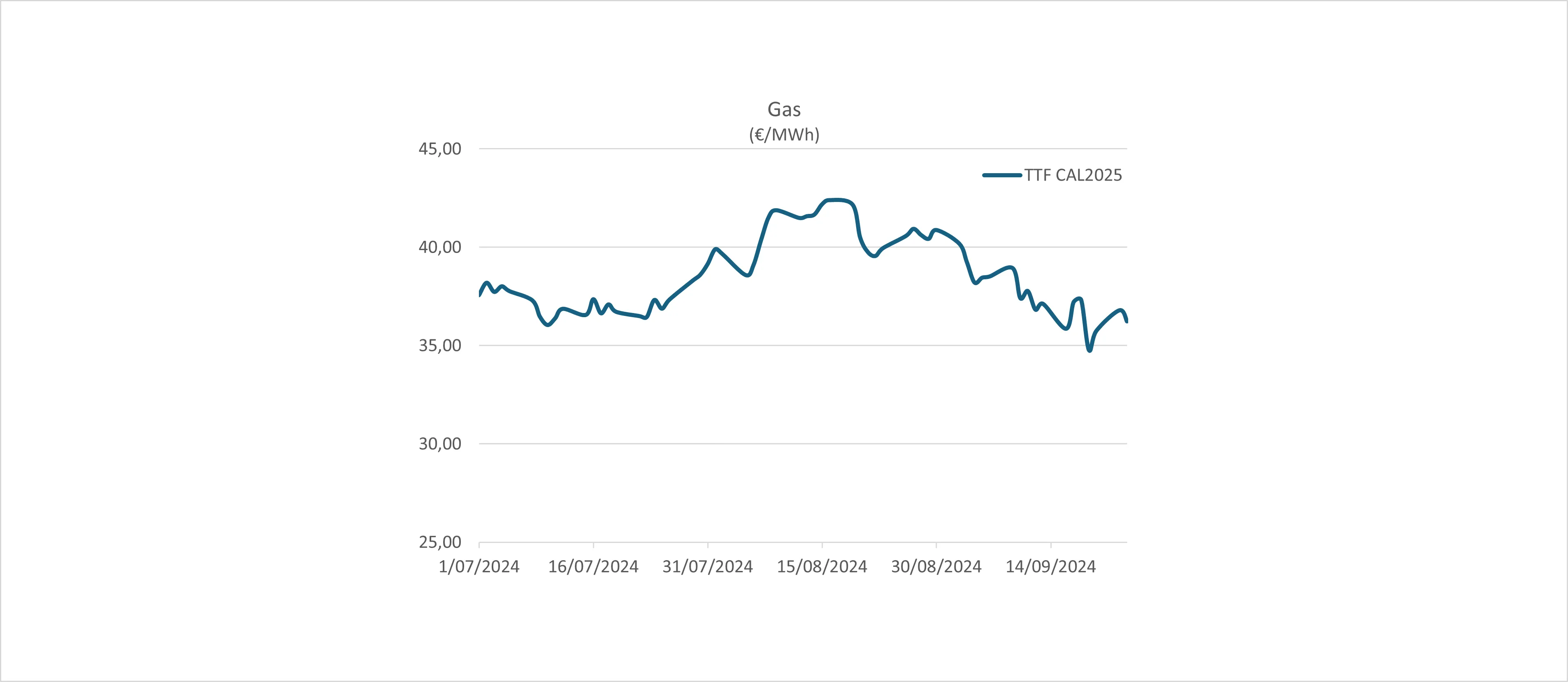

In the summer months of 2024 the same thing happened again: the energy markets reached a (new) record high. Not to the extremes of 2022 but still considerably higher compared to previous trading months. The Dutch TTF natural gas front year price for example reached a peak price level of 42,40 EUR/MWh for TTF Y+1 on the 16th of August marking the highest trading price since the beginning of the year. On spot the TTF gas market averaged out at 37.60 EUR/MWh, the highest price level so far in 2024. For reference the highest average spot price level during the winter was 29.90 EUR/MWh (January).

For a lot of market participants these high summer spot prices gas came as a surprise as overall demand in Western Europe was almost 4% lower compared to the same period last year (and 2023 was not a great year in terms of gas demand from both the industrial and power production perspective). Gas storage levels were filled up to 80% prior to the start of the summer and it quickly became clear that the pace of the injection could easily result in hitting the 90% mark well before the start of the actual heating season. At the same time LNG flows into Europe were reducing but still sufficient enough to cope with overall demand on a daily basis.

In the electricity market a similar scenario unfolded with German spot prices peaking at 82,15 EUR/MWh on average in August. The French equivalent was significantly cheaper at 54,09 EUR/MWh but is was still 20 EUR/MWh higher than the average spot value registered for June 2024. In the forward market both countries saw record high front year prices at 100,35 EUR/MWh (Germany) and 86,00 EUR/MWh (France). In Belgium the front year power price peaked 95,04 EUR/MWh (16/08/2024 – 2024 high at 97,86 EUR/MWh in May).

So what triggered this upward price trend in both the spot and forward market over the summer? The direct answer to that question is geopolitical tensions. Over the course of July and August the conflict in the Middle East started to escalate again leading to increased risk premiums as several market participants feared the worst. The latter being a physical supply shutdown of roughly 20-25% of the worldwide crude oil and natural gas flows passing overseas in the region. Closer to home the conflict between Ukraine and Russia intensified and moved on to Russian soil with fights in the vicinity of the gas transit facility of Sudzha, Kursk. On a daily basis the pump station pushes 40 million cubic meters per day towards the Slovakian border where the pipelines finally branch off towards Czechia and Austria. General fear was an immediate shutdown of pipeline flows by Russia putting the European market in a stressed supply situation. This almost half a year ahead of the expected shutdown, as the gas transit agreement between Russia and Ukraine expires end of 2024.

The indirect answer is a combination of several factors: The first being weather related. With heatwaves striking mainly the Southern European countries but also countries within the Asian region (Japan and China amongst others) higher demand for energy, i.e. more electricity for cooling purposes, pushed the short-term price levels up. Warmer weather forecasts for September, beginning of October shifted the upward trend towards the front month and quarter delivery periods. For the winter months in 2024 and Q1 of 2025 the gas supply risk was translated into a huge forward premium. With the gas market still anticipating a cold winter season (despite that fact that in some Western European countries a real winter has been absent in the past 2 to 3 years) forward prices reached new highs.

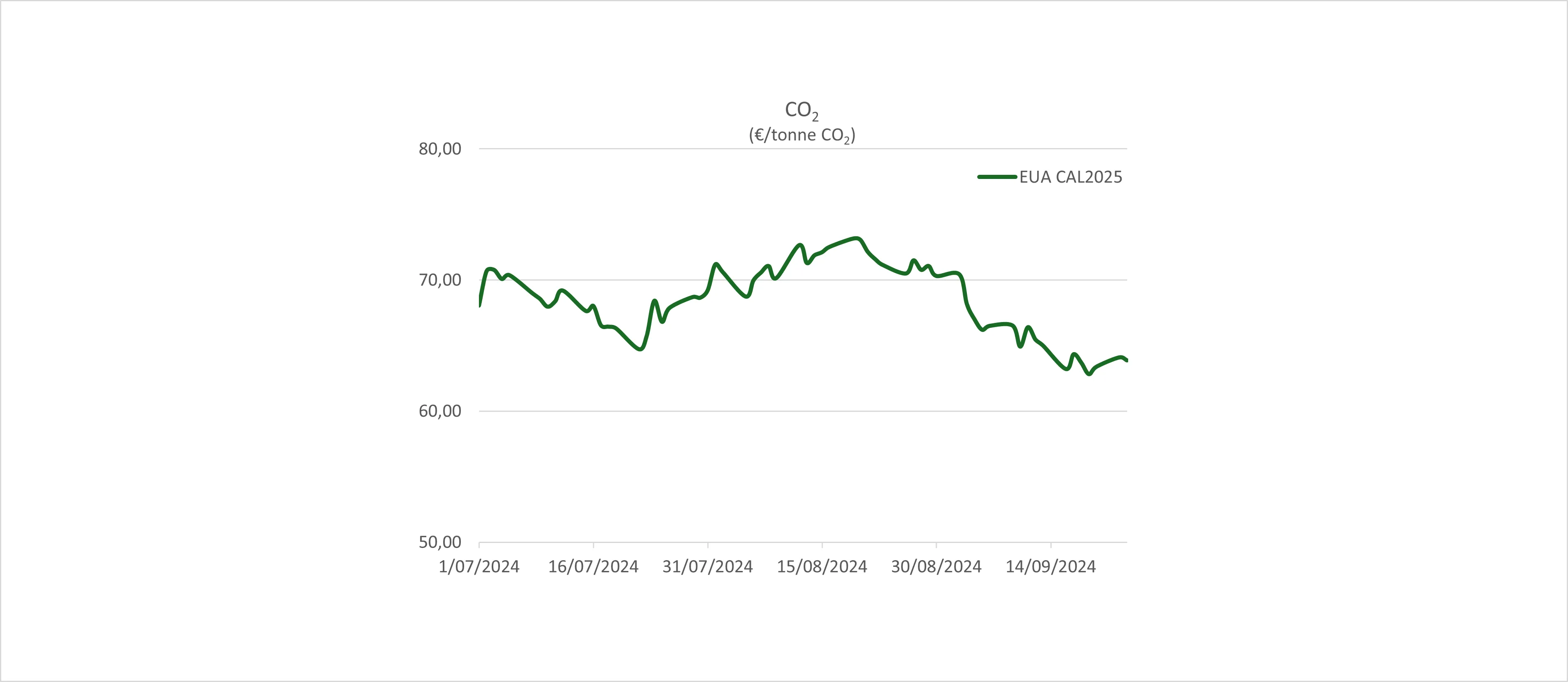

Second explanation can be found in the carbon market where the gas market bull run triggered a new peak spot price level of almost 74.50 EUR/ton mid-August. A dip in the coal price at that time boosted the EUA demand as there was a short “in the money momentum” for coal-fired power plants. In addition and contrary to previous summer periods there was no lull in the EUA auction activity. The ETS compliance deadline for 2024 being pushed towards the end of September being the main reason for that.

Finally the volatile market evolution over the summer months can also be linked to the unclear economic outlook. Mixed signals caused first upward and latter on downward pressure on both spot and forward power and gas prices. Energy demand expectations were a bit more positive ahead of the summer vacation period, following hopeful signals earlier in the year. Despite historically low gas and power demand figures, industrial activity within Europe was gradually picking up and a tiny growth was noticeable in the first six months of 2024. The European economy grew 0.3% in Q2 2024 compared to the previous quarter and the prognosis at that time was still an overall GDP growth of 1.0% in Europe and 0.8% in the Eurozone near the end of the year. End of May the EU Commission growth outlook was set at 1.6% respective 1.4%. The oil market evolution seemed to back-up the upward trend as the Brent price level resettled above the 80 USD mark. US summer demand for oil and oil derivate products was stronger than expected and the OPEC+ cartel kept a lid on overall supply.

That being said the general oil price evolution was much more bearish than bullish with trading activity within the range of 75-85 USD/barrel. Near the end of the summer period the overall oil market price was closer to 70-75 USD as there were indications of a cooling down of the Chinese economy. Closer to home we could notice a fierce price correction in the European energy markets. Both power and natural gas prices on spot and forward, especially the front year delivery period, came tumbling down on the back of reduced risk premiums and a meagre economic outlook. The first being linked to the fact that there is more than 90% natural gas in storage two months ahead of the winter heating season and the fact that there is still a daily Russian gas pipeline flow via Ukraine into Europe. The latter being linked to the recent announcement of the ECB to lower the interest rate by 25 percentage points and the slightly downward revision of the economic growth outlook for the Eurozone. Most likely the US Federal Reserve will follow suit later this month (marking the first interest rate cut since early 2020).